The rules of Dynamic Pricing:

Dynamic pricing is one of the most intriguing points in the evaluating scene at the present time, with digitalization giving numerous incredible chances to organizations to be more responsive with their valuing & pricing. Yet, regardless of its tech underpinnings, dynamic pricing requires solid human oversight coordinated by a clear strategy.

Dynamic Pricing is surely not new, having been spearheaded via airlines during the 'seventies and presently generally utilized by Hotels, airlines, and vehicle rental and tourism administrators. Following the traveling business, we're seeing an ever increasing number of players outside tourism towards dynamic Pricing, like major online retailers like Amazon, Uber, Careem, Deliveroo

What's more, it's not exclusively being utilized in online environment. Customary bricks and mortar organizations are additionally reforming how they adapt, discovering better approaches to take advantage of clients' readiness or willingness to pay.

Digitally Empowered

This shift has been to a great extent empowered by digitalization; information is turning out to be all the more luxuriously accessible, processing power is increasing and new advancements like electronic sticker prices are arising that make it a lot simpler at organizations to change costs rapidly and viably.

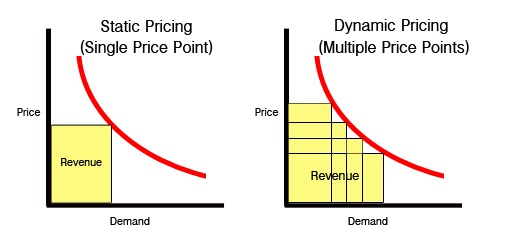

Dynamic Pricing can be understood by more extensive move towards customization and personalization with the rise of information – organizations presently have the ability to more deeply study their clients and separate client portions by value affectability and price sensitivity, connecting this understanding with key market factors, like organic market, supply and demand timing and perishability.

The capability of dynamic Pricing is enormous. Organizations have newly discovered approaches to expand adaptation, maximize earning potential, lessen waste and achieve supply and demand balance, achieve equilibrium market interest. Dynamic prices permit organizations to react all the more agilely to market patterns.

Nonetheless, powerful valuing, dynamic pricing isn't embraced by all customer groups nor is it suitable to each circumstance. Dynamic pricing & valuing, when utilized aimlessly or in disengagement – without human oversight and a reasonable procedure – can to say the least obliterate standing and erode customer trust, while many will just decide to accept it hesitantly.

We've seen many situations where dynamic Pricing has worked and where it's turned out badly. Here are eight rules of dynamic Pricing:

Do be dynamic when the stock is short-lived or there's a reasonable limit imperative.

At the point when you have a transient fixed stock or capacity limitation and you have a fluctuated ability to pay among your client fragments that is noteworthy, then, at that point you ought to think about unique valuing & pricing. Simply think about the airline business – there is a proper limit as far as seats accessible on a flight and, simultaneously, there is changing readiness to pay that is noteworthy as early bookers are commonly value & price sensitive, though late bookers are normally business clients with higher ability to pay. Thusly, airlines customarily offer less expensive costs for prior appointments that will in general increment as you book nearer to takeoff. Simultaneously, the capacity constraints (limited number of seats on a plane) implies that for exceptionally famous flights and dates, the airline can adapt overabundance interest through more exorbitant costs – this is by and large why peak traveling/make a trip dates will in general have more exorbitant costs than off-peak ones.

Do be dynamic when you can utilize it to adjust market interest (supply and demand).

Changing/dynamic pricing: that can be utilized successfully to adjust supply and demand in market in two-sided marketplace. The exemplary model is Uber and Careem, which utilizes dynamic pricing to boost supply in supply-scant circumstances through higher price, while simultaneously lessen demand to keep up with adequate waiting time occasions for the clients willing to pay a premium.

Through dynamic estimating, the marketplace can adjust supply and demand and guarantee significant delays are avoided, so clients are cheerful, the drivers are glad as they get compensated more per outing, and Uber or Careem is cheerful as it can create more income by optimizing the market place.

Try not to be dynamic on the off chance that it doesn't line up with your strategy.

Since your rivals are utilizing dynamic Pricing doesn't mean you need to stick to this same pattern. Take Uber contender Addison Lee for instance, who clearly states on their site "our costs stay a similar when you book, no flood charges at busy times".

They have chosen not to utilize dynamic Pricing as an essential choice, strategic decision, picking rather to focus on the quality of their service. Each ride they offer ensures a similar value, same sort of vehicle, Wi-Fi, charging of your cell phone, etc. Their decision not to utilize dynamic valuing/pricing has turned into their one of a kind selling suggestion unique selling proposition. What's more, it has paid off – their income has expanded by 41% in the previous year.

Do be dynamic when your cost is liquid, you're flexible and it's expense proficient.

Who might have thought 10 years prior that general stores could move to dynamic Pricing ? Presently it's conceivable with the utilization of advanced sticker prices. What's more, it works in light of the fact that so many of their items have an expiry date – they have transient stock and consequently a stockpile requirement. Along these lines, while there is an income advantage via expanded deals, there's additionally a money saving advantage since grocery stores would now be able to limit squander. Firms can impact 90,000 cost changes a day, and German general stores utilizing dynamic Pricing have accomplished a 2.5% increment in income and an astonishing 36% drop in squander.

Do utilize dynamic Pricing when there's occasional interest.

In these cases, there need not be a stockpile requirement or transitory component, there's no compelling reason to coordinate with organic market, yet there's some direness. Internet retailing monster Amazon has been utilizing dynamic valuing on different items that show irregularity sought after. One model is Pumpkin Pie Spice, an American item which is extremely famous during Thanksgiving and Christmas, which is ordinarily sold for $4.49 on Amazon. Be that as it may, before Christmas, it has been recorded for as high as $8.49. This is simply determined by request during the occasion time frame, affecting clients' readiness to pay. Since clients need the item now and it's anything but a much of the time purchased item, there's restricted value memory and clients are less value flexible – they'll acknowledge the greater cost all the more enthusiastically. Dynamic Pricing can take into consideration powerful adaptation of occasional interest and desperation when value affectability drops.

Try not to utilize dynamic Pricing when there's no irregularity or desperation except for there's full equivalence.

Dynamic Pricing, be that as it may, ought to never be taken excessively far, and surprisingly a market chief like Amazon here and there fails to understand the situation. Costs on Amazon and other online retailers can be completely analyzed utilizing best-value tracker sites. In contrast to flights, items sold online can for the most part be discovered somewhere else in the very same configuration, and there is generally no stockpile limitation. Clients can essentially purchase the item at another retailer in the event that they don't care for the cost, or they can get it sometime in the not too distant future on the off chance that they accept the cost will drop. Indeed, canny customers have figured out how to pay special mind to deals and are very glad to look around on the web. Dynamic Pricing in such conditions can move interest from when buyers wished to buy a thing to when they anticipate that the price should be less expensive, which is unmistakably income problematic for online retailers.

Don't over depend on calculations and disregard the human component.

While dynamic Pricing can be extraordinarily helped by information and calculations, these ought to nor be utilized indiscriminately nor in disconnection, without an unmistakable methodology. Amazon stood out as truly newsworthy when a book, The Making of a Fly, was recorded on the stage for a few million dollars – and it was anything but a blockbuster using any and all means. For this situation, two book retailers were posting a similar book and were following one another. Along these lines, as one raised their value, the other before long followed without anybody checking, until the cost came to $23.7 million. This case underscores that track dynamic costs and apply checks to guarantee costs stay sensible, in accordance with more extensive organization and Pricing objectives. Failing to remember the human component in unique valuing is an assurance for disappointment.

Try not to utilize dynamic valuing in circumstances that can be considered coldhearted or as exploitative.

Unbound powerful costs can make terrible exposure. At the point when Whitney Houston died, the cost of her Ultimate collection expanded from $4.99 to $7.99 on Apple's iTunes Store just a brief time after her demise, bringing Sony Music enduring an onslaught. This 60% expansion was driven absolutely by calculations detecting more appeal for her music. While value climbs because of appeal bode well, to buyers this can appear to be unadulterated exploitative, particularly in delicate circumstances. Client trust is one of the vital components in the accomplishment of any business so consistently ensure that costs are reasonable.

Walking prior to running

These illustrations underline that know your clients, your market and the specific factors relating to your business – item perishability, market interest changes, value flexibility and requirements.

While digitalization has engaged organizations by opening up new and imaginative approaches to adapt their business – having incredible information and calculations now available to them – the human component ought to never be neglected. Truth be told, dynamic Pricing, while dependent on innovation, additionally requires basic business measure changes to succeed, making human information always significant. Dynamic Pricing should be driven by a bit by bit approach, implanted inside more extensive organization and valuing objectives, and based upon an exhaustive comprehension of your item and market.